Two thousand years ago, if someone wanted to make everyone hate them, he’d become a tax collector. Throughout the course of history, taxes and tax collectors were associated with evil and unfairness. Colonists during the American Revolution got fed up with the unfair taxes levied on them by Great Britain; they took out their anger by tarring and feathering tax collectors. In 1723 Christopher Bullock equated “death and taxes” as the only things guaranteed in life. But taxes don’t have to be seen with such a gloomy perspective. By pooling part of its citizens’ money, a government can achieve more with tax money than any one person can do on his or her own, and people should take that into consideration before complaining about the government taking their money.

Taxes in America were harsh in the past, but they remain a necessary evil. Without them the government couldn’t keep order or support its citizens. Defense, Social Security and health insurance each take up 20 percent of the federal government’s budget, and 13 percent goes to safety-net programs designed to help keep people out of poverty. Half of the state and local tax revenue goes to education and health care. Taxes burden individuals, but they bless society.

Looking at who pays the most taxes, the federal government gets more than 90 percent of its money from individuals and corporations. The rest comes from minor taxes like fees and excise tax.

| Percent Federal Income | Type of Tax | Description |

| 40-50 | Income Tax | a percent of a person’s wages |

| 32-40 | Payroll Taxes | social security, insurance and withheld taxes |

| 7-15 | Corporate Tax | imposed on net corporate income |

If the government lessened taxes on individuals, it could only make up for it by increasing taxes in some other sector. Regardless of any budget disputes and arguments about how much the government should tax the wealthy, smoothly running the country depends on income tax.

However, not all economic classes face the same burden of taxation. Even though the top percent generates 19 percent of the income, it pays 37 percent of the government’s income tax revenue. Add in payroll taxes, and they pay 27 percent of combine federal government tax revenue. The combined taxes on the bottom 25 percent only amount to .4 percent because they get reimbursements from the payroll tax and pay a smaller percent of their income.

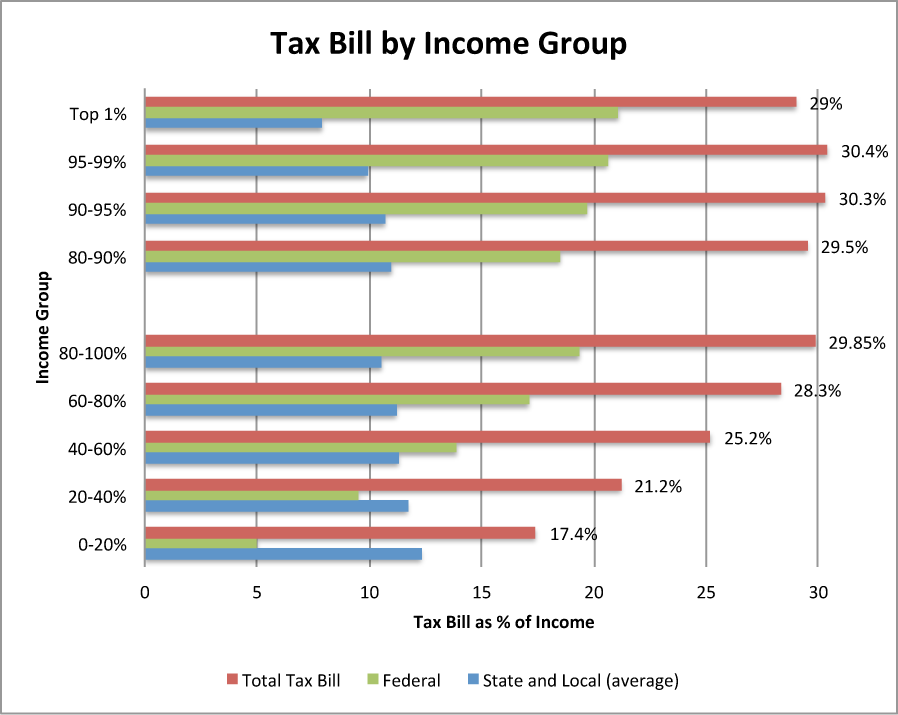

One can’t help feeling sorry for the disproportionately large amount of revenue the wealthy pay to the federal government. On this basis Mitt Romney proposed generous tax cuts on the rich. But consumers feel the burden of more than just federal taxes. State and local taxes constitute a large chunk of the bill, as the chart below shows.

As the chart shows, although the wealthy and middle classes pay mostly federal taxes, the bottom 40 percent pays mostly state and local taxes. And although the wealthy produce considerably more revenue for the government than the rest, they also make much more. In reality they pay about the same percent of their income as the top 40 percent, and the highest percent falls on the middle class.

Granted, the lower classes needs to pay only a small portion of their paycheck because they need their money to help escape poverty. However, if the middle class pays upward of 30 percent of its income, the upper class gets it easy with only 29 percent. The minimal difference in percent translates to a substantial difference in actual tax revenue, and increasing the total tax bill on the rich to perhaps 35 percent wouldn’t make much of a difference to multimillionaires. The rich in America have it easy when compared to countries like the UK, where the top tax bracket gives up 50 percent of their salary in income tax alone.

This tax season don’t think of it as a huge burden when the government collects its due. Lower income groups should rest assured they’ll see much of their taxes again in anti-poverty programs and health insurance. For the middle class, enjoy the infrastructure and national defense. And even though the upper class provides a large chunk of government revenue, it could be paying much more than a mere 29 percent. When the government “steals” your money, remember they could do more with it than you could.