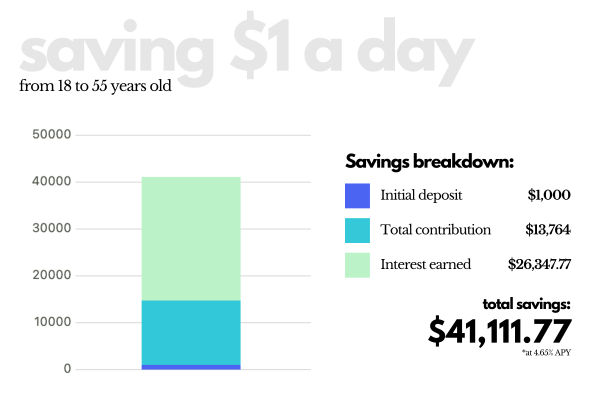

While saving money may not seem important at such a young age, the key to building wealth is starting early. A high-yield savings account (HYSA) is an easy and advantageous way to begin making money on your stored money without any commitment and minimal risk.

1. Find a Bank

Most banks offer some sort of high-yield or performance savings account, but it’s essential to consider the ease of accessing your money and the interest rate on your account. Banks like Capital One and Citi offer 4.3-4.35% APY (annual percentage yield, or interest rate over a period of 12 months) with a simple online interface and in-person locations, while local banks, like PNC Bank or Texas Capital Bank offer 4.65% and 5% APY respectively, but may not have an app that is as easy to use or developed. Some banks charge a fee or require a minimum account to open an HYSA, but it’s generally unnecessary to spend any additional money to open an account. Find a bank that charges no service fees and requires no minimum.

2. Consider Starting Where You Are

Many teens have already opened a checking account and have a debit card. While the rates at the bank you are at may not be as competitive as the rest, it’s convenient to have all your money in one place, and accessible through one account. Additionally, if you need to move money to or from each account, it’s generally quicker if it’s an inter-bank transfer.

3. Determine How Much Money You’ll Move

Starting a savings account can be daunting because your balance in your checking account (or wherever you originally stored your money) drops quickly after moving to a new account. Take a look at what you spend each month, and how much money you make, whether it be from a job, babysitting, etc. Keep about three months of expenses saved in your checking account, for regular spending and in case of emergency, and move the rest to a savings account.

4. Open the Account

With most banks, you can open an account online, in under five minutes. Have your social security number and Taxpayer Identification Number (TIN), if applicable, ready when opening your account. If you are under 18, your parent or legal guardian will need to open the account, and add you as a joint owner. While they legally own the account, you, the joint owner, has the ability to deposit, withdraw, and manage your account, just the same as if you were the full owner. When you turn 18, you can open an independent account and move your savings over.

5. Don’t wait!

You can start making money as soon as you move money into your high-yield savings account. Because opening an account is so quick and easy, you can make money today, even if you’re turning 18 soon, and then move the money over in a few months. Keep in mind, the percentage advertised when you open your account can fluctuate month-to-month, and is calculated over a 12-month period, so if the bank advertises 4.3% APY, you’ll be making .36% monthly.