People often hear about the stock market and its importance in American society and economics but have no idea of how it works. One of the most important aspects of the stock market is investing. Investing, simply, is putting money into the stock market to make some sort of profit. This can either lead to positive or negative outcomes and leave people millionaires or thousands of dollars in debt. Investing often becomes very complex and is seen as something far more complicated than it truly is. Here is how to invest your money into the stock market put in just four steps.

Step 1. Determine how much you are willing to invest

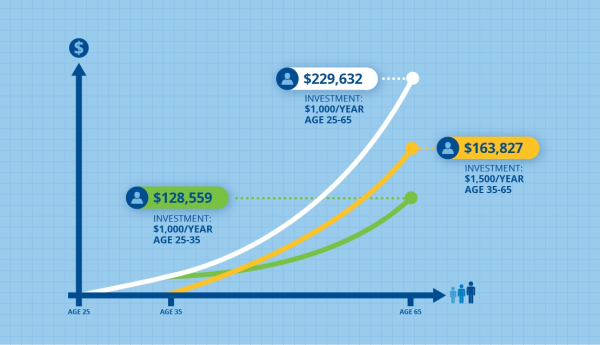

The first step to investing in a stock/fund is determining how much you are willing to invest. A simple way to do this is first to look at how much money you have that you will not need anytime soon. Generally, a good amount of money to invest is $1,000. After this, you have to determine how much you are willing to put into the investment every month or every year. If you put your money into the most common option, a mutual fund, your return rate (amount of profit you get on an investment) will be about 8-15% per year depending on what you choose to invest in. To put this into perspective, starting off with $1,000 and investing $100 every month for 30 years will leave you with $780,000 at the end of those 30 years, meaning you will have made $743,000 in profits. If you start off with $2,000 instead but still invest $100 a month, your profits will only increase by about $80,000. However, starting with $1,000 and investing $200 a month, your profits will increase by $657,000. These numbers might all be going in one ear and out the other, but in essence, starting off with less money and investing more per month will exponentially gain you more profit than starting off with a larger number.

Step 2. Decide what you want to invest in

Once you have decided how much money to invest, you need to decide what type of account you want to invest in:

- Standard Brokerage Account: Investors can easily invest in a SBA through an investment company or bank. Once opened, the investor can invest in a wide array of securities, stocks, bonds and mutual funds.

- 401(K): Being a high school student, you most likely do not have a 401(k) through the company you work for if you have a job. Basically, a 401(k) account is used for retirement and adds money you can access as soon as you retire. For mutual funds (mentioned in step 1) a 401(k) is the most popular type of investment account.

- IRA: Some companies do not offer 401(k) benefits. If you still want to still invest for retirement, an IRA account might be a good option.

Step 3: Open your account

Now that you know which type of account you would like to open, you need to choose an account provider. Although there are many, there are two main options:

- Online Broker: These allow you to self-manage your account. Through an online broker, you can buy and sell a variety of stocks, bonds and funds. This option is good for people who want a large array of investments and want to be able to manage it on their own. Here is how to open one.

- Robo-advisor: Many online investment companies will use a computer to do most of the work for you. This can include everything from managing your portfolio based on your risk willingness to helping reach your goals. Although there is an included 0.25% – 0.5% management fee, robo-advisors can be good for people who want to have an application manage their investment portfolio for them.

Step 4: Only choose investments that match your risk tolerance.

One of the largest parts of investing is figuring out your willingness for risk in your portfolio. Investment risk just means how likely an investment’s stock is to drastically drop or skyrocket suddenly. An investment with a higher risk could potentially make you thousands of dollars overnight, or put you thousands of dollars in debt the next day. Some common investments include:

- Stocks: Individual pieces of ownership of a company that may increase or decrease in value. Learn more about stocks.

- Bonds: Bonds allow a company or even the government to borrow your money and use it to fund a project or finance some debt they have. Bonds usually have a fixed rate of interest return and companies will pay investors to keep a bond open. Learn more about bonds.

- Mutual Funds: Also known as index funds or exchange-traded funds (ETFs) mutual funds allow investors to invest in many different stocks and/or bonds at one time. A good thing about mutual funds is that they add instant diversification to your portfolio meaning that you are instantly investing into a large variety of stocks, which is very beneficial. One of the most popular options is to invest in the S&P 500 which consists of the top 500 stocks in the United States right now.

- Real Estate: Real estate is an amazing way to diversify your portfolio by investing in something outside common stocks and bonds. You do not have to buy a house or become a landlord to invest in real estate. You can invest in a real estate pool of stocks that will allow you to mutually invest in different real estate stocks and bonds similar to a mutual fund.

Building a large and diversified portfolio takes a lot of time and effort in order to get the greatest benefit from each investment. Most first-time investors start off with mutual or index funds to keep risks and costs low and maintain a steady profit. No matter what you decide to invest in, remember to keep in mind risks, types of accounts and ways to open those accounts.